fISH'S kNOWLEDGE bASE FOR eVERYTHING yOU NEED TO knOW

Design Document of Stock Trading Program

Design Document of Stock Trading Program

Design Document of Stock Trading Program

Read the summary of what the Stock Trading Program is all about. This is what is known as the blueprint of the program. Included with snapshots of important areas of the program as well as includes demonstration videos.

Archived Files Assistance

Design Document of Stock Trading Program

Design Document of Stock Trading Program

Detailed descriptions of key components of the Stock Trading Program with visuals.

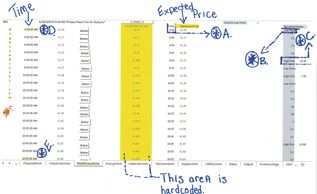

The Example Below Uses the Stock: "BSX" from June 18th 2019.

Enlarged Photos are available for download for maximum viewing.

Methodology of Program with Visuals

Design Document of Stock Trading Program

The FINDEX for BigFishStocks Channels

Click below to find out how members are compensated for supporting the program.

The FINDEX for BigFishStocks Channels

The FINDEX for BigFishStocks Channels

The FINDEX for BigFishStocks Channels

BigFishStocks is on many social media platforms. Need assistance in a particular platform (Twitter--Youtube--Instagram)? Explore this section!

Streaming/Viewing Assistance

The FINDEX for BigFishStocks Channels

The FINDEX for the Cool Pool School

We don't expect our viewers to have any problems while watching the live stream from the website. The stream is viewable from both iOS and Android devices and best viewable in desktop mode.

The FINDEX for the Cool Pool School

The FINDEX for BigFishStocks Channels

The FINDEX for the Cool Pool School

BigFishStocks has a community forum where interested people can share ideas. Click below for assistance in navigating the forum or related topics.

Archived file assistance

Beginning Page of Archived File

Watch Live Video Demonstration Buy

Beginning Page of Archived File

*A: Expected Price- When program is live and when time interval button is pressed OR In the case of back-tested data and the stock market is closed for the day, then the price is the time interval's Close price.

*B: Low Point: Price of Entry calculated by the Program.

*C: High Point- Price of Exit calculated by the Program.

*D: Beginning Time Program Runs

*E: Usual Time where Program finishes for the Day

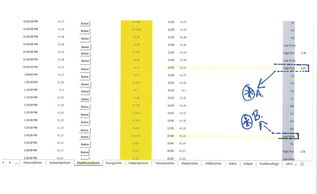

Continued Page of Archived File

Watch Live Video Demonstration Buy

Beginning Page of Archived File

*A: High Point; Long Example- In this example of price activity, the Program determines a point of entry nearly after an hour of monitoring. It might seem long, however, the Program goes through many checkpoints to determine if an entry point should be taken.

*B: Low Point; Long Example- After nearly an hour of monitoring the Program determines an entry price point by satisfying at least one entry point requirement at the various checkpoints.

Watch Live Video Demonstration Buy

Watch Live Video Demonstration Buy

Watch Live Video Demonstration Buy

Live demonstration on 06-21-2019 for BSX Stock. Click the link below to view the video. Please consider viewing the video in full screen mode.

Opening Price of Archived File

Watch Live Video Demonstration Sell

Watch Live Video Demonstration Buy

*A: Opening Price of the Day- Daily Open Price when stock market opens. (In other examples of the Program, this price can be configured as the Stock's Close of Previous Day).

*B: Time @ 3:58- For this price to be 0.00 determines that the archived file used back-tested data.

*C: Potential Profitability Results using standard amount of shares per each Stock/ETF.

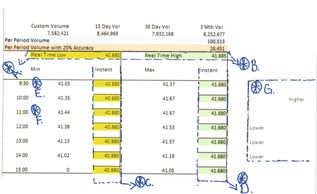

Total Summary of Archived File

Watch Live Video Demonstration Sell

Watch Live Video Demonstration Sell

*A: Real Time Low- Program monitors the lowest price of the day.

*B: Real Time High- Program monitors the highest price of the day.

*C: Real Time Low Instant- Program displays lowest price at exactly 9:30, 10:00, 11:00, etc... When Price is all the same signifies the use of back-tested data.

*D: Real Time High Instant- Program displays highest price at exactly 9:30, 10:00, 11:00, etc... When Price is all the same signifies the use of back-tested data.

*E: 9:30 Min- Lowest price before 10:00.

*E: 9:30 Max- Highest price before 10:00.

*F: 11:00 Min- Lowest price within the the interval of 11:00 and 11:59.

*F: 11:00 Max- Highest price within the interval of 11:00 and 11:59.

*G: Hourly Trend Indicator- Determines the direction the stock is heading hour by hour.

Watch Live Video Demonstration Sell

Watch Live Video Demonstration Sell

Watch Live Video Demonstration Sell

Live demonstration on 06-21-2019 for BSX Stock. Click the link below to view the video. Please consider viewing the video in full screen mode.

Frequently Asked Questions

What's So Important About the STATUS Page?

What's So Important About the STATUS Page?

What's So Important About the STATUS Page?

When checking the archived files keep an eye on the circled area. The circled area shows the potential benefit credits that would be attributable to members.

Where's the Stock's Symbol Name?

What's So Important About the STATUS Page?

What's So Important About the STATUS Page?

Upper left hand corner on the Beginning Page of the Archived File.

Where's the Stock's Volume Data?

What's So Important About the STATUS Page?

What's the Light-Blue Column on The Far Right?

Incremental stock volume is not available in the archived files. Although stock volume is important, the figures run in the background and trying to create screen-shots of the time intervals and volume would be cumbersome.

What's the Light-Blue Column on The Far Right?

What's The Big Yellow Column in the Middle of the Screen?

What's the Light-Blue Column on The Far Right?

That is the program's entry and exit indication system. A Low Point indicator suggests an entry opportunity, whereas a High Point indicator suggests an exit opportunity after entering into a position.

What's The Big Yellow Column in the Middle of the Screen?

What's The Big Yellow Column in the Middle of the Screen?

What's The Big Yellow Column in the Middle of the Screen?

That is the price the program uses to override the streamed price at a given interval. When the market is live it is suggested that the Yellow Column stay clear as there is no need to override the streamed prices.

What are the Notifications and Warnings of the Program?

What's The Big Yellow Column in the Middle of the Screen?

What's The Big Yellow Column in the Middle of the Screen?

A Selection of "NO" initiates the execution command.

*Skip Buying at RTL* ( Buy at the Real Time Low)

*Skip Selling at RTH* (Sell at Real Time High)

*Skip Selling at Too Many Buyers?* (Sell stock when expecting there are too many buyers)

*Skip Buying at Too Many Sellers* (Buy stock when expecting there are too many sellers)

*Skip Selling at High Point Warning* (Sell stock when volume considered low and price of current stock is higher than last interval.

*Skip Buying at Low Point Warning* (Buy stock when volume considered low and price of current stock is lower than last interval.

Copyright © 2020 BigFishStocks.com - All Rights Reserved.

Product of OHAWKS Co.

Frequently Asked Questions Privacy Policy Refund Policy Disclaimers Site Updates